For those familiar with Drucker’s dictum, “What gets measured gets managed,” the era of marketing attribution was a godsend.

It seemed like the glorious resolution to department store and marketing pioneer John Wanamaker’s dilemma from the late 19th century:

“Half the money I spend on advertising is wasted; the trouble is I don’t know which half.”

In the mid-nineties, when the popularity of the internet began exploding, the industry known as e-commerce emerged, and digital advertising took shape alongside it. Marketers could deliver highly targeted campaigns, and it seemed they could now precisely measure the effectiveness of each channel and asset—the promise of 1-to-1 attribution became the golden ticket everyone chased.

This was an exciting prospect that led to a high degree of certainty about what was driving growth.

With access to new streams of data, many marketers believed they finally had full visibility into the buyer journey. But that perceived clarity was often an illusion fueled by data that ignored the more complex, less trackable influence of other factors.

Today, much has changed.

E-commerce is now ubiquitous, and marketing and advertising have reached a level of sophistication that was barely imaginable at the dawn of the internet. And yet, one of the most foundational beliefs of the digital era—the ability to track where a buyer came from and what steps they took to purchase—has begun to unravel.

In today’s article, we attempt to answer the following question: “What’s on the other side of a world without 1-to-1 attribution?”

Buckle up as we take a look at how fintechs and financial services companies should be thinking about marketing effectiveness in a post-attribution age.

What Is Attribution?

At its most basic, the practice of marketing attribution in the digital age seeks to answer the question, “Where did this buyer come from?” so that you can figure out how to optimize that traffic source and increase sales. There are a variety of attribution models that digital marketers have developed and endorsed over the last three decades.

Here are the most common attribution models, broadly divided between single-touch and multi-touch:

- First-touch attribution: Gives credit to the first observable touchpoint a consumer makes with your brand before they make a purchase (or conversion).

- Last-touch attribution: Gives credit to the last touchpoint a consumer makes with your brand before they make a purchase (or conversion).

- Linear attribution: Tracks all the touchpoints a consumer makes prior to conversion and gives them equal weight in the final analysis.

- Lead-conversion touch attribution: This model focuses on the touchpoint that led someone to become a lead in your system rather than immediately prior to a sale.

- Time-decay attribution: Gives touchpoints varying weights, with extra weight given to recent touchpoints.

- Position-based attribution: Prioritizes first and last touchpoints, while maintaining some visibility into the rest of the journey.

You may be wondering about the veracity of any attribution model that relies on digital touchpoints alone.

Obviously, consumers could have any number of meaningful touchpoints with your brand that don’t happen in the digital (i.e., trackable) realm. But this is the allure and inherent shortfall of digital attribution: by virtue of its clarity, it tends to overshadow the messiness of reality.

Also, the only reliable way to create a more comprehensive attribution model would be to interview your customers and hope their recall of events is reliable.

The Evolution (and Devolution) of Attribution

When you break marketing down to its simplest principles, it’s about creating visibility for a product or service that leads to a sale. People can’t buy anything from you if they don’t know that you exist, where to make a purchase, and what you offer.

In small communities and villages, business owners didn’t need much more than a sign above the door and word-of-mouth referrals.

However, we also find plenty of evidence for far-ranging trade networks almost as far back as we can look in the human archeological record. It’s reasonable to assume marketing played a significant role in those transactions.

Archeology also gives us a strong clue that marketing practices have shifted with each era of civilization and commerce. The current evolution of attribution is just one more progression in a cycle that will continue indefinitely. Recent history offers a lot of insight into how we got to where we are.

But, before we go further, it’s important to clarify an often overlooked distinction: attribution and performance are not the same thing.

This is a point that will crystallize as you read this article.

Attribution attempts to explain where a result came from. Performance is about whether something worked and how much lift it created overall for a business.

Just because a channel is easy to measure doesn’t mean it’s the one driving real outcomes. In fact, the most measurable tactics often ride the wave created by harder-to-track efforts like raising brand awareness. Understanding this difference is key to making sense of why/how attribution has evolved in recent years.

The Science of Guesstimating

Prior to the mid-90s—the first first clickable banner ad was launched by AT&T in 1994— marketing was mostly measured using “guesstimates” to approximate how much a given campaign or tactic was responsible for the overall lift in sales.

With the notable exception of direct-response marketing (some would say “junk mail”), marketers relied on qualitative feedback to gauge effectiveness.

They would conduct surveys, assemble focus groups, and conduct interviews to learn about consumers’ experiences in discovering, buying, and using products or services. They would also analyze sales data to look for correlations between advertisements and fluctuations in purchase volume.

They could tell that advertising and marketing were effective, but it required methodical experimentation to identify the causal relationships between a given tactic and the results it generated, hence John Wanamaker’s dilemma.

Digital Measurability

For two and a half decades after the mid-90s, digital marketing offered a revolution in measurement and attribution. The promise of watching the paths of individual consumers as they approached the point of purchase was intoxicating for nearly everyone.

The discipline became so precise that many marketers sought to optimize their sales funnels so that a $1 invested would generate $1 in directly attributable sales. Once a prospect or customer was added to their database, subsequent profits would come from low-cost marketing such as email.

Marketing technology companies and ad networks powered by paid advertising offered the ability to target and retarget prospects and buyers with unbelievable precision, allowing companies to reach consumers at the moment when their intent to buy seemed highest.

The Death of Attribution

In five years since the start of the 2020s, the regime of granular digital attribution has changed radically.

It began to evolve (i.e., crumble) as Apple introduced App Tracking Transparency, and consumers gained more and more control over their data privacy. In other words, the firehose of behavioral data that marketers relied on for their attribution models began to dry up.

One of the most credible, and insightful voices in this change has been Rand Fiskin at SparkToro. He wrote a piece in 2024 that laid things out in crisp detail.

There were additional significant factors that led to the shift in what data was available and how it could be legally used. Some of them were made in the interest of consumers; others were a symptom of competition between large tech companies hoping to exert greater control over their online ecosystems.

Why Traditional Attribution Models Fail

Although more commerce is happening digitally than ever before, fintech marketers know less and less about those transactions, where they came from, and which tactics are worth repeating.

There have always been holes in the argument that digital attribution could solve Wanamaker’s dilemma for good. Recent developments have made it clear: if marketers want to measure their effectiveness, conventional attribution models and tech won’t cut it.

Inherent Limitations

Attribution models have always created an artificial sense of certainty around the customer journey.

A bit like taking a picture of someone standing on your front porch immediately before they knock on your door, and then assuming that all your best visitors come from your front porch. Obviously, they don’t, but that’s where you took the best picture, and nobody can argue that point.

One of the most significant oversights that resulted from the era of attribution was a failure to properly value brand marketing, where the primary objective is teaching consumers to recognize your brand without asking for a sale.

Especially as consumers adopted smartphones, tablets, smart TVs, and smart speakers, the path to purchase became increasingly complex and recursive. True believers in digital attribution wanted linearity because it was easier to measure and plan for. Consumers never got the memo.

Platform Incentives

In the last half of the 2010s, social media platforms aggressively shifted their strategies in an attempt to prevent users from leaving their “walled gardens.”

If a user clicked on an ad or piece of linked content, it was better for Facebook’s ad revenue if that user didn’t move to a website hosted outside of Meta’s domain.

The same is true of X, LinkedIn, and other platforms. They want to keep users close and scrolling, all the better to track their behavior and sell “attributable” ads inventory to marketers. This has given rise to a phenomenon known as zero-click content.

Technological, Legal, and Behavioral Changes

Much of the data that made attribution possible was invisible to the people creating it, much less the fact that data brokers were selling it at a profit to marketers and other companies.

The passing of the European General Data Protection Regulation (GDPR) law and the California Consumer Privacy Act (CCPA) both triggered sea changes in the way companies treated consumer data and designed their technology systems.

Consumers also adopted their own defenses against third-party tracking, such as ad-blockers and VPNs (Virtual Private Network). When you consider the proliferation of multiple smart devices (phones, tablets, TVs, and speakers) and isolated app experiences (i.e., more walled gardens), it’s no wonder that true visibility into the consumer’s journey became nearly impossible to achieve.

Another more recent development is AI-powered search results, which are upending one of the primary channels (i.e., paid and organic search) that companies have used to reach consumers and drive traffic.

Again, all of these factors have put more and more pressure on attribution models, causing them to resemble the front-porch scenario from earlier–you really don’t know anything about how they got there.

A New Approach: Lift Over Attribution

It makes sense that fintech and financial services marketers want to track the effectiveness of the things they’re paying for, such as social media ads and pay-per-click (PPC) ads.

But the reality is that performance-based marketing techniques will only ever reach around 5% of a B2B audience at a given time (the numbers are a little higher for B2C). The other ∓95% of your potential buyers will only be receptive to brand marketing tactics that don’t push for a sale. This insight comes from work done by Prof. John Dawes at the Ehrenberg-Bass Institute, in cooperation with LinkedIn.

In short, the hypothesis that we can know exactly how many customers any given ad or specific channel has generated is no longer supported by the technology or the data.

What you can do is adopt a measurement framework that looks at the overall marketing lift for your funnel and treats it comprehensively and acutely.

It’s comparable to the way you manage your physical well-being: you adopt healthy eating, sleep, and exercise behaviors because they support your entire body. When you notice an acute issue, such as abnormal pain or symptoms of disease, you seek professional guidance on how to take a holistic approach to healing the problem.

This underscores the fact that you need to invest in brand marketing as a comprehensive strategy to support your business long-term. You execute more short-term performance marketing tactics to target willing buyers (i.e., the people on the “front porch”) and invite them to make a purchase.

This requires generalizing your data collection efforts and measuring marketing lift over longer periods. If you want precise data on a channel or tactic, you may need to turn the channel off for 3-6 months to establish a baseline. Then, you resume the channel and closely monitor traffic and sales.

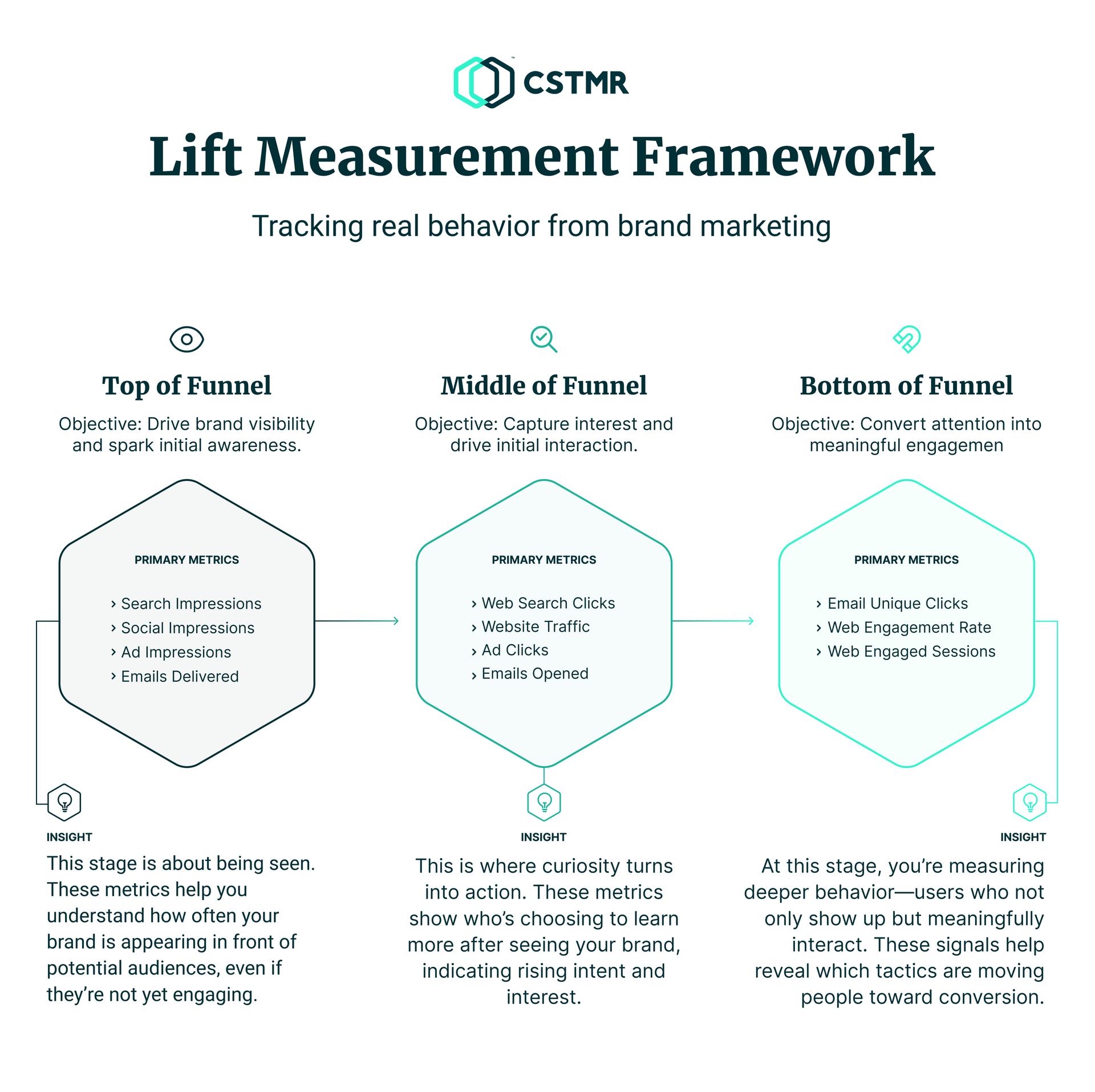

The graph below provides a helpful framework for how you can think about the different stages of the consumer journey and the lift metrics that correspond. Keep in mind that the metrics shown aren’t exhaustive, but they represent the core indicators of marketing lift at each stage.

Brand awareness is measurable, even if it isn’t as precise or clear-cut as we’d like it to be. We recommend most companies start by monitoring the following metrics:

- Direct traffic

- Social media engagement

- Search volume and keyword data

- Surveys and polls

- Brand name mentions

The goal is to find the baseline values for your brand over time and then watch how those metrics change when you introduce new channels, tactics, and technologies.

7 Tips to Get in the Right Mindset (or Better)

Many marketers are feeling despair over the death of high-fidelity tracking systems, but that doesn’t mean you should feel despair. Advertising and marketing thrived before digital attribution arrived on the scene and it will thrive long after it’s gone.

The harsh reality is that many channels with provable ROI are simply claiming credit for channels that aren’t as visible (e.g., the metaphorical “front porch” vs. the entire journey leading up to it).

Here are a few suggestions that we make to our fintech and financial services clients to help them establish confidence in the future of marketing effectiveness:

1. Have a List of Channels and Tactics That Focus On User Behavior

Keep a living list of channels and tactics that appear to be effective, but focus on observable user behavior in the numbers. These channels and tactics will vary based on the stage of the funnel (see the chart above), but the goal is to measure data holistically with respect to meaningful actions.

Anecdotal evidence can be helpful, as is the input of your team. When in doubt, directly ask your customers for their feedback.

2. Have a List of Experimental Channels and Tactics You Want To Test

Alongside your core strategy, maintain a working list of bold ideas and experimental channels you want to try. Bold experiments can reveal more than small tweaks when you’re evaluating overall marketing lift. With calculated risks, you might just discover a high-impact lever that attribution models would have overlooked.

3. Test Turning Channels Off and On Over Time

The only way to truly understand what’s working is to systematically eliminate variables so that you can identify the most influential factors. One of the best ways to isolate the impact of a specific channel is to pause it entirely. This helps establish a baseline and reduces the noise from overlapping efforts. If you want to know the real impact of a channel or tactic, remove it from the equation and watch what changes.

NPR deleting its Twitter/X account is an excellent example.

4. Study Your Customers’ Top-of-Funnel Behavior

Understanding discovery behavior is essential, as top-of-funnel activity is not only where brand impressions are made, but it’s also where traditional analytics tend to fall short. Pay attention to the ways your audience stumbles across your brand. Metric to pay attention to include organic search impressions, social impressions, ad impressions, and emails delivered.

This discovery data will help you better understand, nurture your target audience to the point of sale, and give context to downstream performance.

5. Understand Conversion Behavior Through the Funnel

While KPIs can show you what happened, they rarely show why. That’s why it’s critical to dig deeper into your customers’ conversion stories. Talk to them. Ask about their path to purchase, what moved them, what slowed them down, and what made them trust you. This may require in-person interviews, but these insights will help you align your efforts with the nuances of your target market.

6. Monitor Broadly (and Regularly) Enough to Spot Disasters Signals

Post-attribution marketing isn’t about “no more measurement.”

It’s about a different philosophy of measurement. It’s like being a meteorologist; you don’t measure air temperature and humidity on a single street; you watch weather fronts and regional patterns, so you aren’t surprised when major shifts happen. You need to observe your marketing ecosystem over time—across multiple channels, campaigns, and audience segments—to get a clearer picture of what (if anything) is shifting and why.

7. Don’t Abandon Disciplined Strategy and Execution

Losing attribution doesn’t mean you’ve lost control. It just means you need to rely on a more holistic, long-term view (i.e., “lift”).

That starts with staying rooted in strategic thinking and disciplined execution. Don’t let frustration with imperfect data cause you to abandon what works. Marketers have always relied on creativity, intelligent planning, and resilience to grow their brands. Those same attributes are even more important now that strategy will no longer be driven by the artificial certainty of attribution.

The Future Is Different, But Bright

Although some would say marketing attribution is dead (we prefer “evolved”), marketing is very much alive.

In our experience, many of the channels that are the hardest to attribute also have the lowest competition and the highest potential for brand awareness. Opportunity is hiding in plain sight, and financial services companies that have the courage to pivot their KPIs will enjoy sustained ROI.

The new rules of measuring marketing are really just the old rules. The pre-digital rules.

Behaviors around technology have changed a lot in the last few decades, but the fundamentals of consumer psychology haven’t. People will buy from brands they recognize or when urgency forces them to make a choice anyway.

Done well, brand marketing helps you develop familiarity with your ideal audience so that when urgency strikes, you’re the first thing they think about.

In the words of Professor Dawes from the 95/5 study, “The brand that gets remembered is the brand that gets bought.” At CSTMR, we help fintech and financial services brands establish awareness where it matters and deploy performance-based tactics when it makes sense to do so–when they can have the highest impact.

If you’re ready to leave artificial certainty behind for something more lasting and powerful, schedule a call with our team and let’s map out your brand’s future together.